FSAs

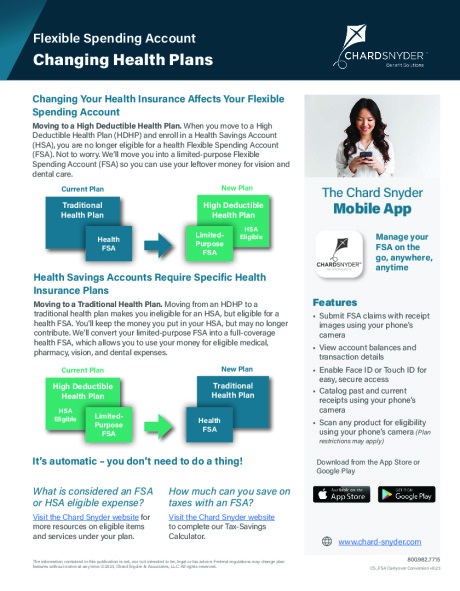

Flexible Spending Accounts (FSAs) are designed to save you money. They work in a similar way to a savings account.

Each pay period, funds are deducted from your pay on a pre-tax basis and are deposited to your Health Care and/or Dependent Care FSA. You then use your funds to pay for eligible health care or dependent care expenses.

With an FSA, the money you contribute is never taxed – not when you put it into the account, not when you are reimbursed with the funds from the account, and not when you file your income tax return at the end of the year.

FSAs are administered by Chard Snyder. Annual contribution limits are set by the IRS.

| Account Type | Eligible Expenses | Annual Limits | Benefit | |

|---|---|---|---|---|

| Health Care FSA (for employees not participating in the HSA) | Most medical, dental and vision care expenses that are not covered by your health plan (such as copayments, coinsurance, deductibles, eyeglasses and doctor-prescribed over the counter medication) | Maximum contribution is $3,400 per year | Saves on eligible expenses not covered by insurance; reduces your taxable income | |

| Limited Purpose FSA (for HSA enrolled employee only) | Dental and vision care expenses that are not covered by your dental or vision plans (such as copayments, coinsurance, deductibles, surgery, and orthodontia.) | Maximum contribution is $3,400 per year | Saves on eligible expenses not covered by insurance; reduces your taxable income | |

| Dependent Care FSA | Dependent care expenses (such as day care, after school programs or elder care programs) so you and your spouse can work or attend school full-time | Maximum contribution is $7,500 per year ($3,750 if married and filing separate tax returns) | Reduces your taxable income | |

| Transit | Bus passes, subway vouchers, passes or tokens, train vouchers, passes or tokens, and vanpooling fees. Eligible transit expenses must be work related. | The maximum monthly Transit election is $340 | Set aside funds pre-tax from your paycheck for qualified transit expenses. | |

| Parking | Metered parking, monthly and/or daily parking fees for parking lots and/or ramps, park n’ ride lots, and parking at mass transit facility. Eligible parking expenses must take place at or near your place of employment, or at a location from where you commute to work. | The maximum monthly Parking election is $340 | Set aside funds pre-tax from your paycheck for qualified parking expenses. | |

Important Information about FSAs

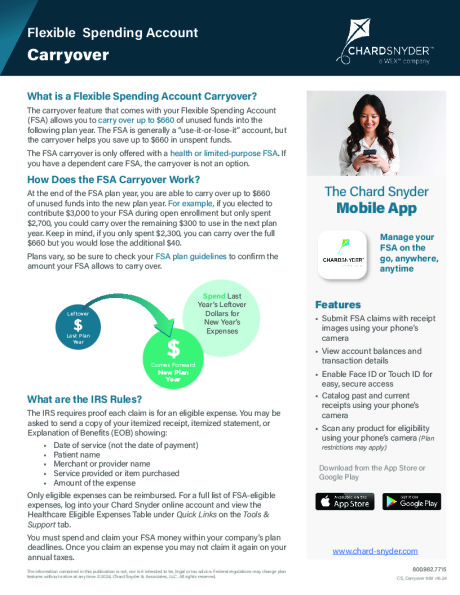

Your FSA elections will be in effect from January 1 through December 31. All expenses must be incurred within the calendar year. Claims for reimbursement for the Health Care, Limited Purpose and Dependent Care FSAs must be submitted by March 31 of the following year. The Health Care and Limited Purpose FSAs allow up to $680 to be rolled over into the following year. Any money remaining in your account after March 31 will be forfeited. This is known as the “use it or lose it” rule and it is governed by IRS regulations. Please plan your contributions carefully. Note that FSA elections do not automatically continue from year to year. You must actively enroll each year.

Your Parking and Transit elections will rollover each year. Mass Transit tickets/passes must be purchased with the debit card provided. Claims for reimbursement for the Parking and Transit plans must be submitted within 180 days of the date of service.