Which Medical Plan is Right?

Evaluate Your Needs. Consider your prior health care usage and select plans and options that fit your lifestyle and needs.

- Do you take regular prescription medications?

- Are you anticipating surgery or non-preventive dental care?

- Did you experience a qualifying life event this year?

- Review your current plans to ensure you have the coverage you need.

Review this benefits website to learn about your plan options.

A little bit of planning will help you select the best plans, coverage levels, and financial programs for your unique situation.

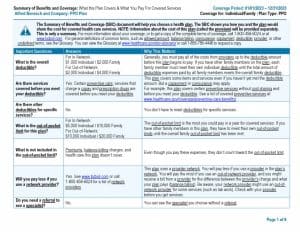

Medical Plan Comparison

Plan Option Summary

Benesch offers the option of a Traditional PPO or High Deductible Health Plan (HDHP) administered through Blue Cross Blue Shield of Illinois.

Please note that the network is nationwide, even though the plan is administered by BCBS of Illinois. For more detailed coverage information, please refer to the BCBSIL plan documents.documents.

| Plan Options | Traditional PPO* | High Deductible Health Plan (HDHP) |

||||||

|---|---|---|---|---|---|---|---|---|

| Calendar Year Deductible | In-Network | Non-Network | In-Network | Non-Network | ||||

| Embedded – no one individual must meet more than the individual limit | Embedded – no one individual must meet more than the individual limit | |||||||

| Individual | $1,500 | $3,000 | $3,200 | $3,200 | ||||

| Family | $3,000 | $6,000 | $6,400 | $6,400 | ||||

| Out-of-Pocket Max | Includes your Deductible | Includes your Deductible | ||||||

| Individual | $5,000 | $10,000 | $5,000 | $5,000 | ||||

| Family | $10,000 | $20,000 | $10,000 | $10,000 | ||||

| Coinsurance – You Pay |

In-Network 20% |

Non-Network 40% |

In-Network 20% |

Non-Network 40% | ||||

| Wellness/ Preventive Care Visit | $0 | 40% after deductible | $0 | 40% after deductible | ||||

| Physician Care Visit | $25 copay* | 40% after deductible | 20% after deductible | 40% after deductible | ||||

| Specialist Office Visit | $50 copay* | 40% after deductible | 20% after deductible | 40% after deductible | ||||

| Urgent Care | 20% after deductible | 40% after deductible | 20% after deductible | 40% after deductible | ||||

| Hospital Services | In-Network | Non-Network | In-Network | Non-Network | ||||

| Inpatient | 20% after deductible | 40% after deductible | 20% after deductible | 40% after deductible | ||||

| Outpatient | 20% after deductible | 40% after deductible | 20% after deductible | 40% after deductible | ||||

|

Complex Imaging (MRI, CAT, PET, etc.) |

20% after deductible | 40% after deductible | 20% after deductible | 40% after deductible | ||||

| Emergency Room | $400 Copay* (waived if admitted) plus 20% after deductible |

10% after deductible | ||||||

| Rehabilitation Services | In-Network | Non-Network | In-Network | Non-Network | ||||

| Physical, Speech & Occupational Therapy | 20% after deductible | 40% after deductible | 20% after deductible | 40% after deductible | ||||

*For the PPO, copays do not count towards the deductible, but do count towards the out-of-pocket maximum.

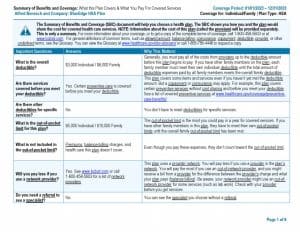

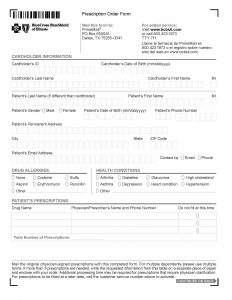

Prescription Plan

All medical plan participants have prescription drug coverage based on their selected plan. A way to save money is by requesting generics and/or mail order options when available.

| Prescription Drug | Traditional PPO* | High Deductible Health Plan (HDHP) | ||

|---|---|---|---|---|

| Retail Prescription Drug Copays Via Prime Therapeutics* |

$15 / $50 / $75 / 20% coinsurance Out-of-Network, responsible for copay plus 25% of eligible amount |

20% after deductible Out-of-Network, pay 40% after deductible + 25% of eligible amount after payment | ||

| 90 Day Mail Order Prescription Drug Copays Via Express Scripts |

2 x Retail (In-Network Only) |

20% after deductible (In-Network Only) | ||

| Specialty Prescription Drugs Via Accredo |

20% to $250 Max (In-Network Only) |

20% after deductible (In-Network Only) | ||

*For the PPO, copays do not count towards the deductible, but do count towards the out-of-pocket maximum.

**To access your pharmacy benefits, link out to MyPrime via the BCBS Member Portal.

Employee Contributions

Finding A Physician

Visit www.bcbsil.com and click “Find a Doctor or Hospital.”

You may search either by physician name or network; the network for each of the plans offered is:

- Participating Provider Organization (PPO)

| Bi-Weekly Medical Contributions | HDHP Plan | PPO Plan |

|---|---|---|

| Employee | $64.45 | $125.74 |

| Employee & Spouse | $130.59 | $236.21 |

| Employee & Child(ren) | $111.38 | $210.53 |

| Family | $184.76 | $340.14 |

Blue Access for Members (BAM)

- All participants have access to BAM. You may create your own account at www.bcbsil.com

- Members can check the status of claims, view benefit information, access wellness information, compare hospitals, request replacement ID cards, and more.

- Employees can even access their accounts through their mobile or smart phone

Blue365 ®

Blue365 is a discount program for members. With this program, you can save money on health care products and services that are most often not covered by your benefit plan. There are no claims to file and no referrals or pre-authorizations.

See all the Blue365 deals and learn more at www.blue365deals.com/BCBSIL.

MDLIVE Telehealth

Virtual Visits, provided by Blue Cross and Blue Shield of Illinois (BCBSIL) and powered by MDLIVE, allow you and your eligible family members to see a doctor wherever you go, whenever you need a doctor.

MDLIVE is a service outside of your traditional in network provider access. MDLIVE offers the following:

- Telemedicine visits

- Calls for non-emergency medical issues such as cold, flu, ear infection, pink eye

- Visits via phone or video

- 24 hours a day, 7 days a week

- Employees and covered dependents

- The cost is standardly $48 (behavioral health could be more) until the deductible is met

- Then $20 copay after deductible for PPO / $10 copay after deductible for HDHP

There is no charge to set up your account, but you may have a charge for your visit depending on your benefit plan.

Activate your account – pick the way that is easiest for you:

• Call MDLIVE at 888-676-4204

• Go to MDLIVE.com/bcbsil

• Text BCBSIL to 635-483

• Download the MDLIVE app