Voluntary Benefits

ID Theft Protection, Accident Insurance, Critical Illness Insurance, and Hospital Indemnity coverage are available to you, your spouse, and your dependent children. However, employees must have coverage in order for their spouse and children to obtain coverage.

Voluntary Benefits are just that, voluntary. The costs for voluntary benefits are 100% paid by the employee.

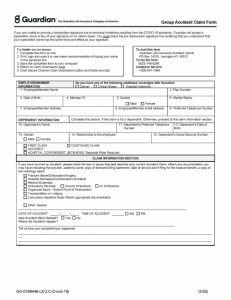

Voluntary Accident Insurance

Accident Insurance is administered through Guardian.

Group Plan = 00039752

Member ID = Member SSN

Accident Insurance provides an extra layer of protection that gives you a cash payment to help cover out-of-pocket expenses when you suffer an unexpected and qualifying accident.

This covers accidents that occur on and off the job. It also provides additional Accidental Death and Dismemberment coverage (on top of your Basic Life and AD&D coverage). Qualifying accident expenses could include ambulance, burns, blood/plasma/platelets, accidents occurred with a covered child is participating in an organized sport, comas, concussions, dislocations, dental crowns, eye injuries, fractures, and many more.

Please refer to your official Guardian plan documents for full details surrounding this coverage.

| Accident Rates | Rate Per Pay Period |

|---|---|

| Employee | $3.52 |

| Employee + Spouse | $5.67 |

| Employee + Child(ren) | $7.62 |

| Employee + Spouse + Child(ren) | $9.77 |

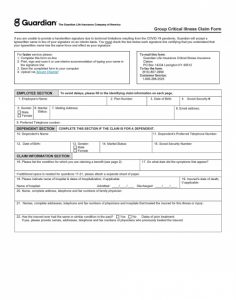

Voluntary Critical Illness Insurance

Critical Illness is administered through Guardian.

Group Plan = 00039752

Member ID = Member SSN

Critical Illness Insurance gives you a cash payment to help cover out-of-pocket expenses should you experience a serious illness such as cancer, a heart attack, or a stroke, giving you the financial support to focus on recovery.

You may choose to elect a lump sum benefit of $10,000 or $20,000. Acquiring certain conditions can allow you to receive 100% of that lump sum if it is either the first or second occurrence.

Eligible conditions include but are not limited to cancers, vascular issues such as a heart attack or stroke, organ failure, kidney failure, loss of sight/hearing/speech, ALS, and more.

| Employee Rates | <30 | 30-39 | 40-49 | 50-59 | 60-69 | 70+ | ||||||

| $10,000 Coverage | $1.43 | $2.45 | $4.71 | $9.42 | $16.15 | $25.66 | ||||||

| $20,000 Coverage | $2.86 | $4.89 | $9.42 | $18.83 | $32.31 | $51.32 | ||||||

| Spouse Rates* | <30 | 30-39 | 40-49 | 50-59 | 60-69 | 70+ | ||||||

| $10,000 Coverage | $1.43 | $2.45 | $4.71 | $9.42 | $16.15 | $25.66 | ||||||

| $20,000 Coverage | $2.86 | $4.89 | $9.42 | $18.83 | $32.31 | $51.32 | ||||||

*spouse coverage premium is based on employee age

*spouse benefit amount cannot exceed employee amount

Child cost is included with employee election

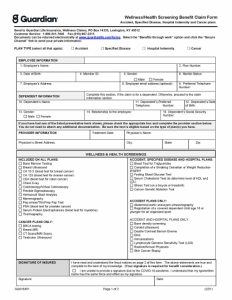

Voluntary Hospital Indemnity Insurance

Hospital Indemnity is administered through Guardian.

Group Plan = 00039752

Member ID = Member SSN

Hospital Indemnity Insurance can cover some of the cost associated with a hospital stay.

Benefits incurred from a hospital/ICU admission or confinement can be used to pay for deductibles and copays, travel to and from the hospital for treatment, and even childcare service assistance during recovery.

| Hospital Indemnity Rates | Rate Per Pay Period | |

| Employee | $4.72 | |

| Employee + Spouse | $11.52 | |

| Employee + Child(ren) | $8.44 | |

| Employee + Spouse + Child(ren) | $15.24 | |

Identity Theft Protection

This ID-Theft Protection benefit is available to all Benesch employees on a voluntary basis.

In today’s world, cybersecurity is more important than ever. LifeLock gives you an extra layer of assurance that your identity is being protected. LifeLock with Norton Benefit Plans combine leading identity theft protection with device security and protection against online threats to block thieves from stealing personal information from PCs, Macs, and mobile devices.

Lifelock Features

-

LifeLock Identity Alert System

- Monitors for fraudulent use of your social security number, name, address, or date of birth in applications for credit and services

-

Dark Web Monitoring

- Patrols the dark web and notifies you if they find your information on dark websites and forums

-

LifeLock Privacy Monitor

- Scans common public people-searching websites to find your personal information and help you opt-out

-

Lost Wallet Protection

- If your wallet gets lost or stolen, LifeLock can act as a resource to assist with canceling/replacing credit cards, driver’s licenses, social security cards, insurance cards, etc.

- 24/7 Live Member Support

- U.S.-based Identity Restoration Specialists

- Fictitious Identity Monitoring

| LifeLock Premier Rates | Rate Per Pay Period | |

|---|---|---|

| Individual Coverage | $6.23 | |

| Family Coverage | $12.45 | |

| LifeLock Essential Rates | Rate Per Pay Period | |

| Individual Coverage | $3.69 | |

| Family Coverage | $7.38 | |

Level Up Friday – LifeLock Employee Webinar

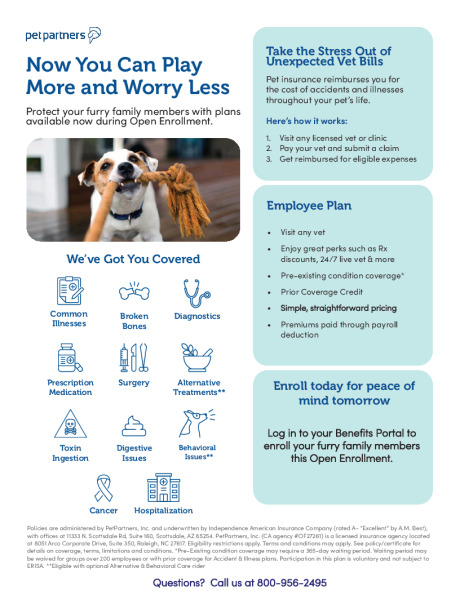

Voluntary Pet Insurance

Benesch cares about all our employees and families, including our pets! Because pet care is expensive and veterinary costs continue to rise, Benesch offers all benefit eligible employees, pet insurance!

Pet insurance reimburses you for the cost of accidents and/or illnesses throughout your pet’s life. After a $300 deductible, the plan will pay 80% up to a $5,000 annual limit. There is also an optional wellness rider you can purchase to cover specific amounts for preventative visits. There are additional maximum allowable limits for wellness care.

You can enroll pets from 8 weeks to 10 years old. If your pet is 11 years of age or older, they are not eligible for coverage as a new enrollee. If a pet turns 11 years old after enrolled, coverage will continue.

Coverage for pet insurance will be effective on the 1st of the month following enrollment for new hires and Qualified Life Events.

Here’s how it works:

- Visit your vet (or any licensed vet or clinic)

- Pay your vet, then submit a claim via PetPartners

- Get reimbursed for eligible expenses

What’s Covered (Accident/Illness)

- Pre-Existing Conditions*

- Broken bones

- Diagnostics

- Surgery

- Prescription medication

- Toxin ingestion

- Digestive issues

- Cancer

- Hospitalization

*Pre-Existing condition coverage may require 12-month waiting period.

What’s Covered (Wellness)

- Office Visit/Exam

- Heartworm Test/Feline Leukemia

- Rabies/Preventative Vaccines

- Flea/Tick Prevention

- Blood, Fecal, Parasite Test

- Urinalysis

- Spay/Neuter

- Microchip

| Species/Age | Accident & Illness | Accident, Illness & Wellness |

|---|---|---|

| Dog (Age 0-10) | $28.54 | $37.30 |

| Cat (0-10) | $14.37 | $21.18 |

Rates per pay period